(Kuala Lumpur, Johor and Penang)

24 Years of experience in MM2H. Support for Study Abroad.

Pros and Cons of Malaysia Property

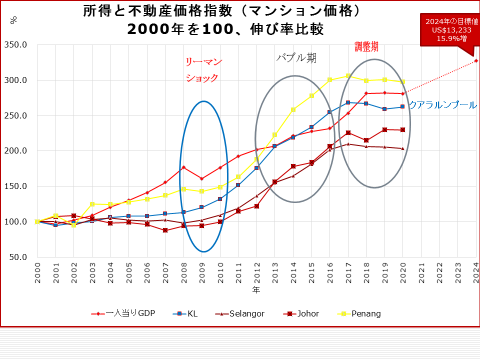

5) Real estate prices and income index

Malaysia is developing rapidly and it is on course to transform from a middle-class nation to a developed nation.

The GDP per capita income of Malaysia, which is a benchmark for developed countries, has already reached the figure of 15,000 US dollars.

As mentioned in the section on the population pyramid, the number of people in their 20s and 30s is on an upward trajectory.

With such a background, real estate prices in Malaysia are increasingly rising as shown in the price index (condominium price) since 2000.

The blue line is Kuala Lumpur's real estate price index shows as 100 in 2000. It has increased to about 260 (2.6 times) in 2020.

The red line is the income per person, but the income also increased by about 280 (2.8 times) during the same period.

In addition, Penang has experienced the biggest price surge during the same period.

The reason of the increasing price of real estate in Penang (rise to about 300 or 3 times) is due to scarcity of land coupled with strong economic growth.

Johor’s real estate prices picked up from 2010, and prices have begun to rise rapidly since then.

The catalyst of growth is due to the inflow of investments into Johor under the Iskandar project

The population growth rate and income per capita in the Iskandar region is on an uptrend

One needs to pay attention to is the transition of price trends, and prices have risen significantly nationwide from 2011 to 2017.

his period is called Malaysian real estate bubble period.

Local banks were very supportive in mortgage lending to locals and foreigners. Many investors, purchased Malaysian real estate during this period

As a result, Malaysian real estate prices rose faster than the income growth, and many people voiced their dissatisfaction reading this phemomenon.

As a result, the Malaysian government has taken a policy to curb the rise in real estate prices since around 2016.

The main countermeasures are tightening of mortgage lending and raising the real estate gains tax, which takes effect in 2017.

After the tightening polity was introduced, real estate prices declined marginally in 2018 and 2019.

During the Pandemic Era (Covid-19) in 2020, and it was thought that real estate prices would fall further.

As a result, mortgage interest rates have fallen sharply in 2020. The real estate market has also recovered slightly since second half of 2020, and the decline has stopped. Currently in 2023, Malaysia’s real estate sector has rebounded from the lows during the Pandemic Era and in currently on an upward trajectory. This growth is supported by the robustness of the Malaysian economy and the stable population growth.

The Malaysian government is targeting to become an advanced nation before the year 2025,

and is working to increase the income per capita by taking a supportive policy of focusing and fostering high value-added industries such as IT,

Finance and high-tech manufacturing industry.

On a local currency (Ringgit) basis, the income growth continues to increase by an annual rate of 5%. (On a US dollar basis, the currency has depreciated since 2020)

As the economy recovers, , income per capita is expected to rise again, and in relation to this, real estate prices is expected to gradually increase.