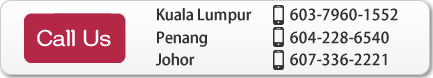

(Kuala Lumpur, Johor and Penang)

24 Years of experience in MM2H. Support for Study Abroad.

Key points to success in Malaysian Property investment

6) Key points for success

1) Choose a property that is popular among locals

Most of the properties bought by the Japanese were resold to local buyers. Therefore, it can be assumed that it will be difficult to resell the property if the property is not popular among locals, and it will be difficult to resell it at the desired asking price.

2) Be careful of properties eyes by many investors!Be careful of properties eyes by many investors!

Many properties bought by investors are not for their own stay(residential), but most of the investors want to use the properties for rental and resell them when the price increases. You will face difficulties in both renting and reselling the property.

3) Be careful when choosing properties in the city center of Kuala Lumpur!

In KL, prices of properties in the suburbs with good access to highways and close to train stations are increasing more than those in the city center. In terms of renting, the rental market for properties in the city center is limited, and many owners have difficulty in renting their properties. Careful selection is necessary when choosing properties in the city center.

The reasons are:

1) There are very few locals living in the city center (actual consumer group), and most of the property owners in the city center are investors;

2) Most of the tenants are foreign expatriates, including Japanese, and most of them are factory workers, and their workplaces are located in the suburb areas, there are few expatriates who rent properties in the city center area.

most tenants are foreign expatriates, including Japanese, and many of them work in factories in the suburbs, causing only a small number of expatriates are renting properties in the city centre area.

4) We recommend a property with a good location and developed by a reputable and well-established developer

Developers’ branding is also progressing in Malaysia. Properties built by a reputable and well-established developers have better concepts and finishing, and in many cases, the properties’ values are maintained even after completion. In addition, tenants tend to be attracted to properties developed by by a reputable and well-established developers. The following companies are popular as developers.

- Sp Setia

Malaysia's major developer with a good reputation for overall strength. - Ecoworld

Has a good reputation for township and mixed-development. - UEM-Sunrise

A major government-affiliated developer, well-known especially in Johor. - E&O Properties

It is the same company owner of Penang E & O Hotel and is known for its high-quality projects with a strong presence in Penang. - Tropicana Corporation

A company that has developed rapidly nearby Tropicana Golf Club and has grown rapidly in recent years. - Pavilion (Molton):

Pavilion Mall owner company, developing condominiums under the Pavilion brand and growing rapidly. - Sunway

A major developer that developed a town called Bandar Sunway, and has a good reputation for comprehensive development of the university, malls, offices, residential area etc. - Mah Shing

A major company with a good reputation for mixed-development, it is also famous for its modern exterior and design. - Sime darby Property

A major government-affiliated developer based on oil palm plantations with a good reputation for creating new townships. - Ireka Corporation

It is a construction company and developer, and most of its development is in the Mont Kiara area. A good reputable developer with high quality and good design. - IOI Property

A major developer based on oil palm plantations, with a good reputation for creating new townships. - Berjaya Land

A developer of the conglomerate group that develops various businesses.