(Kuala Lumpur, Johor and Penang)

24 Years of experience in MM2H. Support for Study Abroad.

Basic info of Malaysia

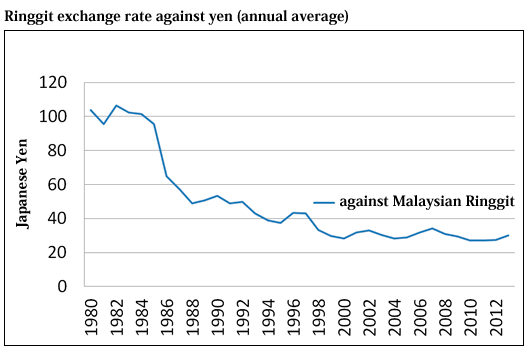

6) Exchange rate between local currency and yen

Below are the exchange rates for Malaysian currency (Ringgit = RM) and Japanese Yen for 32 years from 1980 to 2012.

Until around 1984, one ringgit was about 100 yen, but the yen’s appreciation continued after that,

and the yen appreciated to about 24 yen around May 2011.

In 1973, the US dollar and the Japanese yen became floating exchange rates, and the yen strengthened from a fixed exchange rate of 360 yen to a maximum of 75 yen in 2012, which is similar to the process.

Below is a chart of the exchange rates of Malaysian Ringgit (RM) and Japanese Yen for the past 10 years from 2011 to 2021.

For the past 10 years, it has fluctuated in the range of RM = 24 yen to 35 yen.

Malaysia is a country that produces crude oil and natural gas, and the currency is closely linked to the price of crude oil.

Ringgit also fell from around 33 yen to around 24 yen at the end of 2016 from the first half of 2015 when crude oil prices began to fall sharply.

After that, in 2017 when the crude oil price began to recover, it recovered to about 27 yen, but when the crude oil plummeted again

due to the corona disaster from the first half of 2020, it dropped to about 24 yen, and the crude oil price began to fall from the latter half of 2020.

It has begun to return and has recently returned to just over 26 yen.

However, from a long-term perspective after the 1980s, it can be said that the yen is still at a historically high level.

Crude oil price

Factors that affect the exchange rate are (1) economic growth rate, (2) trade balance (the currency tends to be stronger if there is current account surplus),

(3) resource rich nations (the resource nations tend to pass more strongly),

Malaysia is a resource-rich country, trade has been experiencing surplus since 1998 and inflation is low at 1-2%,

The value of Ringgit began to recover in 2021 in tandem with the recovery of crude oil and natural gas price.

With the current government which consists of a stable political coalition, the conducive investment policy and the ratification of both RCEP (Regional Comprehensive Economic Partnership) and Comprehensive and Progressive Agreement for Trans ? Pacific Partnership (CPTPP), these factors will propel Malaysia’s economy to greater heights.