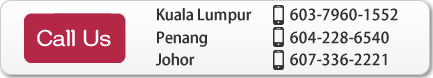

(Kuala Lumpur, Johor and Penang)

24 Years of experience in MM2H. Support for Study Abroad.

Pros and Cons of Malaysia Property

3) Risks and important points

With many years of experience in property related business, we would like to highlight the potential risks of property investments in Malaysia.

1) The risk of incompletion and delay

Some Malaysia developers does not have a strong financial background to undertake projects, so the risks of incompletion or delay is a possible risk. We recommend buyers to purchase the property from a public listed company or developer that are highly reliable in Malaysia.

2) The risk of defect

The property interior’s finishing may fall short of buyers expectation upon completion. When the new property is completed, we should check for defects and request the developer to repair it during the defect liability period (24 months). Also, for purchasers of second hand property, we would advise to factor in the repair costs before purchasing.

3) Defect Liability Period

In Malaysia, the defect liabilty for property is generally 2 years from delivery of vacant possession. (Purchaser buys from developer during construction period). Defect liability period is generally 3 months from the date of keys handover if purchaser buys from developer after the property has been built and completed.

4) Difficulty to rent out

Purchasers may have difficulty renting out their purchased units if the location is not desirable or if the property which they purchased is bought my many property investors. Such situation will increase the risk of rental reduction return as property owner’s competes to attract tenants.

5) Difficulty to sell the unit

Property investors may find it difficult to sell their units due to mismatch of pricing and location for their target markets. Such risks will appear when the property is located further away from public amenities or lacks infrastructure connectivity.

6) Identity of owners and bank valuation

In the event of purchasing of a second hand property from local sellers, buyer should ensure that owner is the same person as in the property registration title. Such verification process can be handled by the real estate agents and lawyers. For buyers who financed their purchase through mortgages, please note that the mortgage amount offered to the buyer is usually 80%-90% of the official property valuation decided by registered property valuers in Malaysia.

7) Brokerage firm baked outside of Malaysia

As Malaysian real estate has become increasingly popular in recent years, the number of international-based companies introducing Malaysian real estate has also increased. Some companies introduce properties without any local infrastructure and without a local license to handle Malaysian real estate. If you purchase a property through such a company, it is common that they do not provide follow-up services (property management and resale support) after you purchase the property. In addition, there are many cases where properties recommended by international-based companies do not match the local real estate market. We have seen many Japanese owners who have purchased properties that are difficult to resell because tenants do not come to the property after purchase

8) Notes related to rights and collateral

When purchasing a second-hand property from a local, there may be problems such as getting scammed and paid some amount of money to said scammer, when in fact the owner of the unit is someone else; the owner is a joint owner and the other owners did not agree to the resale price; or a bank loan collateral has been set above the resale price and registration could not be obtained.

When signing a contract, it is important to hire a local lawyer to clarify the rights and collateral.