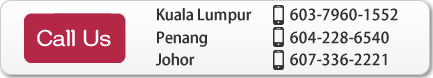

(Kuala Lumpur, Johor and Penang)

24 Years of experience in MM2H. Support for Study Abroad.

Key points to success in Malaysian Property investment

4) Success and Failure Stories

Sample cases of Success and Failure Stories in Malaysian Real Estate

Since 2007, we have been introducing the appeal of Malaysian real estate to the Japanese people and have purchased many properties for residential or investment purposes. Kuala Lumpur has been the most popular city, but we have also had quite a few buyers in Penang and Johor.

Looking back over the past 10 years, we would like to summaries our successes and failures, lessons learned from our experiences and key success factors.

Success Stories: Residential (Condominiums, Landed Houses)

① Condominium (Mr. A, Suburb of KL: 3 years old sub-sale condominium located next to Putrajaya mall and golf course, 3 beds, 140.8m²)

- Purchased for investment in 2010 at RM620,000 (approx. 16.74 million yen, RM=27 yen). Paid 30% by own funds (RM200,000 = about 5.4 million yen), 70% financed by loan.

- During the holding period, loan monthly installment and other expenses were covered by the monthly rental of RM3,500.

- Resold in 2014 for RM820,000 (approx. JPY27.06 million, RM=JPY33). RM395,000 profit on the sale after deducting expenses.

- In Ringgit base: With RM200,000 investment of own funds, he got RM350,000 profit.

- In Yen base: With 5.4M yen investment of own funds, he got 13.04M yen profit.

* Success Factors

- Mr. A bought the property at a low price before the mall was completed and was able to make a capital gain when the mall was completed. As for the rental, the developer offered a 7% guaranteed rental, providing a stable income.

- He invested when the yen was strong, and recovered the fund when the yen was weak.

- He was able to efficiently earn capital gains by taking a loan and reducing his own capital.

② Condominium (Mr. B Suburbs of KL: Newly built condominium in One Utama area, 3 beds, 130m²)

- Purchased in 2010 with RM370,000 (self-financing) for own-stay and spent about RM100,000 on interior renovation to make it a comfortable home.

- Returned back to Japan in 2016 and resold for RM750,000. Gained net profit of RM250,000 after deducting the expenses.

* Success Factors

- He selected the property and location that was popular among locals. Resold to a local.

- He invested when the newly built property was cheap, as the area where the property was located developed, the property price increased significantly.

- There are more real consumers groups compared to investors groups which made the property was easy to be resold.

③ Link House (Mr. C, purchased a newly-built terrace house in Sri Tanjung Pinang, Penang, 4 beds, 230m²)

- Purchased in 2008 for RM730,000 for investment, completed in 2010, and rented it out since then.

- Monthly rental was RM3,500.

- Resold in 2014 for RM1,650,000. Gross profit of RM820,000 including expenses.

* Success Factors

- He was able to purchase a newly built property at the early stage of construction at a cheap price.

- The area of the property has developed into a local luxury residential area by a comprehensive strong and well-branded developer.

The property is popular among wealthy locals, and the resellers are also locals. - The property is popular among the wealthy locals, and it was also resold to a local.

④ Landed house (Mr. D, Suburb of Kuala Lumpur: Semi-detached house in Setia Eco City, 4 rooms, 280m²)

- Purchased in 2009 for RM850,000 from a developer for own-stay (70% loan).

- Interior renovation cost RM120,000 and stayed with family. Resold for RM 1,900,000 in 2015.

- Net profit of RM850,000 after deducting expenses.

* Success Factors

- Purchased a newly built property at the early stage of construction at a cheap price.

- The area of the property has developed significantly as a new town by a comprehensive strong and well-branded developer.

- Highly livable property with lots of greenery and parks made it popular among the locals. The property also was resold to a local.

Success Stories: Commercial Properties (Commercial Shops)

① Sectional title ownership of shop lot (Mr. E, owned a high-end residential property in Kuala Lumpur and a shop lot in a mall at a commercial area named Mont Kiara, 105m²)

- Purchased from a developer in 2008 for RM847,350 by cash.

- After completion in 2011, rented it out to a popular restaurant with a rental of RM5,500/month.

- After that, the rental increased every year up to RM10,000/month in 2015.

- Resold for RM2,700,000 in 2016.

* Success Factors

- He bought a new property located in a good location from a well-known developer at a cheap price.

- With the comprehensive strength of the developer, the mall where the shop lot is located has developed into a popular mall among wealthy local people and foreigners.

- The tenanted restaurant was very popular, their sales increased and the rental also has been raised up. There is also an advantage to having a restaurant as a tenant because once established, it will not move out.

Failure Stories: Residential Properties (Condominium, Landed house)

① Condominium in the center of KL (Mr. F, purchased a 2 years old sub-sale condominium near KLCC, 1 bed, 62m²)

- Purchased at RM650,000 for investment in 2009 (by cash).

- Most of the property owners are investors, causing an over-supplied rental market. The properties here were difficult to rent out, and most of the tenants are short-termed rentals by Middle Eastern tourists.

- The sub-sale market price as of 2016 was about the same as the purchased price, and no profit on the resold property.

- The property’s finishing was also not so good and there was also a considerable amount of repair costs incurred such as water leaks.

* Failure Factors

- Although the location was located in the city center, it was just an ordinary condominium that has no added value such as being located adjacent to a mall.

- As for the rental market in Kuala Lumpur, there are many properties that are difficult to rent out due to the limited number of tenants in the city center and over-supplied. It can be said that it was a wrong choice as an investment property.

- The properties here were bought by the property investors who wanted to rent out the units, and there are not many owners who actually live there.

② KL city center condominium (Mr. G, purchased a newly built condo next to a golf course in KL city center, 2-bed, 93m²)

Purchased in 2014 at RM1,098,000 for investment. It was thought that the property could be rented out easily because it was located in the city center and also has a golf course view, but in reality, it was inconvenient for shopping, eating and drinking, and the car access is slightly inconvenient too, so it was difficult to get tenants. The sub-sale market also is not very strong, and the current market price is about the same as the purchased price, so no capital gain can be expected.

③ Hotel property with guaranteed-rental

There are quite many projects in KL, Penang, Malacca, etc. which sell hotel rooms with guaranteed rental. It is important to know who guarantees the rental payment, if the hotel management company guarantees the rental payment, there are cases where the rental payments are not paid. Hotel rooms are not suitable for long-term stays or for own-stay, and if the hotel operation is stopped, it can be said that it is difficult to find other options, except for hotel usage.

Failure Stories: Commercial Properties (Shop lots and offices)

① Sectional title ownership of shop lot (Mr. H, owned a terraced commercial shop lot in a residential area in the suburbs of Kuala Lumpur, double-stories, 330 m²)

Purchased in 2010 from a developer at RM1,598,000 by cash. After completion in 2013, the unit was still vacant for rental. Most of the nearby shop lots were used as warehouses.

After 18 months, the property was rented by a mobile phone sales company for RM3,500/month. Unfortunately, during the tenancy period, the tenant didn’t pay the rental on time and ran away without notice. The property was resold at RM1,180,000 in 2016.

* Failure Factors

- The property was located in a poor location for commercial purposes and the property was purchased from a small-medium-sized developer.

- The developer focused only on selling the properties and did not touch the operation after completion. The individual owners were not able to attract tenants with good businesses.

- Since the properties were not attracted to the good tenants, the properties were used as warehouses and caused the value of the property decreased.