Total support for Malaysia real estate!

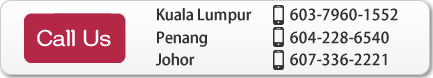

(Kuala Lumpur, Johor and Penang)

24 Years of experience in MM2H. Support for Study Abroad.

(Kuala Lumpur, Johor and Penang)

24 Years of experience in MM2H. Support for Study Abroad.

* Rate: 1MYR = 39.85JPY (as of 20/02/2026 16:00)

Overview of Malaysian Real Estate

1) Property Type Overview

1. Residential Properties

Landed Houses

-

(Terrace House)

Terrace House (a row of attached houses with shared side walls) -

(Semi-Detached House)

Semi-Detached House (a single-family home that shares one common wall with one other home; 2 units in a row) -

(Detached House)

Detached House (a stand-alone residential structure that does not share outside walls with another house)

<Features>

- The most desirable type of house among the locals are landed homes. Landed houses, with the size and prices increasing from terrace house to semi-detached house to detached house: terrace house → semi-detach → detach. Size of terrace house (2floors) is 150m²-250m², semi-detached 200-400m², and detached 300-500m².

- Landed properties in Malaysia will have the best capital appreciation . However, generally, the landed houses’ rental yield is lower compared to condominiums.

- Recently, gated and guarded landed house development have also become popular among the affluent locals because of its good security.

Condominium or serviced apartment

<Features>

- Condominiums and serviced apartments equivalent to mansions in Japan , which are built on the residential land title, are called condominiums, and those built on commercial land title are called serviced apartments. Serviced apartments and condominiums are essentially the same. The only difference is the yearly tax payment and utility tariffs ( Electricity and Water tariffs are higher in commercial properties)

- The sizes ranges from 1-bed (room), 2-beds, 3-beds, 4-beds and above, but generally the size for 1-bed 40-100 m², 2-beds 60-120 m², 3-beds 80-200 m², 4-beds of 200-500 m², it can be said that it is considerably larger than mansions in Japan.

- Condominiums in Malaysia comes modern amenities such as swimming pools, gyms, 24-hour security, and some even have tennis courts. Because of the everlasting summer climate, the swimming pool is an important facility which can be enjoyed all year round.

- In terms of security, condominiums are safer compared to landed houses, so it can be said that the condominiums are more suitable for foreigners. Generally, most foreigners living in Malaysia prefers to live in a condominium due to its facilities and security.

2. Office Properties

- Office Building

- Compartmentalized(strata) ownership

- Shop office

<Features>

- As mentioned above, there are several types of office investment. For purchasers with bigger budget, one can opt to invest in a single office building. In some cases, the office building is sold separately lot by lot (about 100-1,000 m²), which is suitable for investors with smaller budgets. Locally, it is also called a shop office, and it is also possible to purchase a 2-4 story of multi-stories property that both can be used as a shop and an office in one unit or one building.

- Generally, gross rental yields for office is 5-8%.

- The office market is booming in Malaysia, due to the growing economy in Malaysia. Foreign companies are projected to increase their investments in KL, Johor, and Penang

3. Commercial property

- Shop lot

- Shop office

- Mall building

<Features>

- As Malaysia is aiming to double its income in the next 10 years, consumption is increasing every year, making it a promising place to invest in commercial properties.

- In some cases, it is possible to buy the shop lot in the shopping mall on a fractional ownership basis. Popular shopping centres are promising investment targets as they can generate high rental income and the rental also increases every year.

- You can also invest in shops and offices. Most purchasers will buy a single unit on a single floor, or you can buy a whole unit with 2-4 stories.

- Commercial investment properties are popular with local professional investors, as property prices can rise sharply as they become more popular. However, the investment amount will be larger than a residential housing investment, and the bank loan financing ratio is lower compared to residential properties. It can be said that the commercial property investment is suitable for investors who has higher budget and aiming for higher return on investments.

- For real estate investment trust fund (REIT) investment, there are few investment themes offered in Malaysia, such as Grade -A office buildings, factories and warehouses and shopping malls. Singapore-based Capitaland and Malaysian institutional investors are also actively investing in shopping malls. REIT funds generally generate 6%-8% of profit return annually.

At present, there are currently 16 REIT funds listed in Malaysia, and the number is expected to increase in the future. All these funds are regulated by the Malaysian Stock Market Exchange (BURSA).