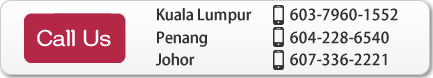

(Kuala Lumpur, Johor and Penang)

24 Years of experience in MM2H. Support for Study Abroad.

International Taxation and Asset Management in Malaysia

Local taxation: Malaysia is a resource-rich country with low taxes!

Malaysia is a resource-rich nation that exports oil and natural gas. About half of the current national budget is covered by tax revenues and dividends from the Malaysian Petroleum Corporation (Petronas).

Malaysia is blessed to be a resource-rich country that does not need to collect high taxes from its citizens and companies.

By residing in Malaysia, you can benefit from low taxes. If you take proper measures, you can also save on some taxation. Below is an explanation for commonly induced tax.

-

Residency Tax

Currently, there is no residency tax in Malaysia. This is a great advantage for MM2H (Malaysia My Second Home) visa holders who stay in Malaysia for a long period of time and use the infrastructure and public services in Malaysia without paying taxes.

Suggestion: By obtaining MM2H or Permanent Resident status and moving your address from to Malaysia, you do not have to pay resident tax in your country.

-

Consumption Tax

Currently, there is no consumption tax in Malaysia. There is only a service tax, which is levied on the use of hotels, restaurants, and professional services such as lawyers and accountants. The current service tax rate is 8% (Some consumer based things will stay at 6% such as Food Beverages and telecommunication). -

Assessment Tax

This is also inexpensive compared to other countries. The tax rate will vary depending on the city and whether the land is residential or commercial, but for a typical condominium of about 100 square meters, the annual tax rate is approximately RM1,000.

Suggestion: Instead of owning real estate in other countries, where property prices are on the decline and property taxes are high. Owning real estate in Malaysia where property prices are on the rise and property taxes are low can be a more tax-efficient real estate investment.

As shown below, there is no inheritance tax or gift tax in Malaysia. -

Inheritance and gift taxes

This is also not in Malaysia. Rich locals do not have to worry about inheritance tax. If a Japanese person acquires real estate in Malaysia, there is no local inheritance or gift tax. However, if you are a resident of some country such as Japan, you will be subject to inheritance tax and gift tax in the country for your Malaysian assets

Suggestion: If a couple acquires MM2H and live in Malaysia for more than 10 years, they may be exempt from some inheritance and gift taxes that arise between the couple. (Please check with an international tax specialist for details.)

-

Income tax

Expatriates who have income in Malaysia are subject to income tax in Malaysia. Residents who are in Malaysia for 182 days or more are subject to a progressive tax rate of up to 28%. Non-residents are taxed at a flat rate of 28% on their income in Malaysia. If you own rental property in Malaysia and have rental income, the local income tax rate will apply. -

Corporation tax

For corporations, the maximum tax rate is 24%; profits below RM500,000 are taxed at only 19%.

Suggestion: If a company is expanding internationally, it may be possible to relocate its headquarters to Malaysia to save on taxes. (Please consult with an international tax specialist for more details.)

-

Taxes on income from overseas sources

Malaysia takes the stance that income derived from outside the country is not taxed in Malaysia. Long-stay residents in Malaysia will not be taxed if they bring their pension or other income received in other country into Malaysia.

As the location of people's lives and asset holdings tend to become more globalized, the option of "becoming a non-resident of origin country" may be worth considering. For more information, please contact an international tax specialist. We can also introduce you to specialists in this field. Please feel free to contact us.

Local asset management methods: Asset management that might be impossible in your country is possible!

Malaysia is a fast-growing emerging economy that aims to become a developed nation with the goal of doubling its income in 10 years and a population that is expected to increase by about 20%, especially among young people. In a country like this, various asset management (asset building) options are available, which are no longer possible in some country.

-

Spending Money in Malaysia: The Best Asset Management.

The best way to manage your assets using Malaysia is to spend money in Malaysia.

Since the cost of living in Malaysia is roughly 1/3 of that in developed country, money spent in other country will be worth 3 times as much in Malaysia, meaning that a pension of 1000 dollar will be worth about 3000 dollar. This is especially beneficial for pensioners who are planning to stay in Malaysia for a long time and spend their money here.

-

Fixed deposit interest rate: about 2.8-3.2% per year, with no tax on interest!

One of the next reliable asset management options is to "utilize Malaysian bank deposits".

Currently, bank interest rates in Malaysia are around 3-3.2% for a 1-year term, and up to 4% for a 5-year term. (Please note that bank interest rates are constantly changing and vary from bank to bank!) Thankfully, there is no tax on interest income, so the interest income is entirely your own income.

Moreover, Malaysia has a deposit protection system, which guarantees up to RM250,000 in one bank, and up to RM2,500,000 if you use 10 banks. The Malaysian central bank is strictly supervised and no bank in Malaysia has ever gone bankrupt. That means bank deposits in Malaysia can be considered safe.

However, to open a bank account in Malaysia, you will need a local visa such as MM2H visa or work visa. It is not possible to open a bank account with only a passport. -

Financial products other than bank deposits 1: Long-term accumulation of life insurance allows compound interest of 5% or more.

Malaysia also has long-term accumulation deposits sold by insurance companies, which can be invested at a compound interest rate of about 5%.

-

Financial instruments other than bank deposits 2: Real estate investment trusts (REITs)

There are currently 16 listed real estate investment trusts (REITs) with dividend yields ranging from 5-8% after tax. Taxation is only 10% withholding. Malaysian REITs are a recommended financial instrument because of their guaranteed dividends and the ability to resell them at any time in the market.

-

Oil Palm Plantation Investment: Coconut oil, the most competitive Malaysian agricultural product.

The oil palm industry, the source of coconut oil, is the most competitive and profitable agricultural industry in Malaysia. Major Malaysian conglomerates such as Sime Darby and IOI are reaping huge profits from oil palm plantation operations.

Oil palm plantation developer Golden Palm and other companies are selling products that securitize profit rights and return the proceeds to investors. They guarantee a 6% dividend for the first 6 years and a minimum of 9% after 7 years (if the CPO price is above RM1,500 per ton). -

Real estate investment: Capital gains are possible, and local loans are available for foreigners.

Real estate investment is promising, considering that Malaysia's income will grow significantly in the future and the population of young people will increase. Considering that Malaysian real estate is still only 1/5 to 1/4 of that of Singapore. When compared to the price of real estate in Singapore, It is a market with ample potential for capital gains in the future. There is also the advantage that foreigners can get a mortgage.