Total support for Malaysia real estate!

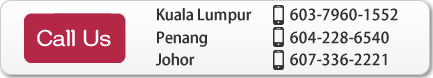

(Kuala Lumpur, Johor and Penang)

22 Years of experience in MM2H. Support for Study Abroad.

(Kuala Lumpur, Johor and Penang)

22 Years of experience in MM2H. Support for Study Abroad.

* Rate: 1MYR = 33.40JPY (as of 13/05/2024 15:46)

Key points to success in Malaysian Property investment

2) Specific investment strategies

-

Purchase new properties at an early stage at a low price.

In Malaysia, the selling price is lowest when the property is put up for sale before construction starts, and the selling price is increased as construction progresses and as the property sells. It is normal for prices to rise by 20-30% from new offer to completion. In properties that have become popular, the price can rise by as much as 50%.

In the case of new buildings, construction takes about three years from start to completion, so on average you can aim for a capital gain of 20-30% per year over a period of three to five years. Of course, it depends on the location of the development property, the concept, the credibility of the developer and sales trends, but this is usually the most solid way to go. -

Investing by anticipating the city planning

In the emerging country Malaysia, national projects are ongoing, and due to the ongoing projects, there are properties with high potential to increase in price not only in the ongoing development projects but also in the surrounding areas.

Obtaining information on large projects for example like the property projects along the MRT line in KL, at or nearby Iskandar Malaysia project - a special economic zone in southern Johor, and nearby the Penang Second Bridge, which connects the south-eastern part of the Penang Island to the mainland, and buying properties at the right time is also a reliable investment method. -

Buy in bulk and negotiate the price

As a Malaysian business practice, there is a possibility to negotiate the price with the developer that sells the properties. Usually, if you buy more than 5 units, you may be able to get a discount. -

Buying during a recession

The real estate market also goes through boom and bust cycles in tandem with the economic situation, such as the Lehman Shock in 2008, which caused the property prices in the center of KL area to drop by 20-30%.

Not only the property prices become cheaper, but the interest rates of the bank loans will also drop, and developers will offer various incentives (perks and incentives) to recoup their sales.

In Malaysia, the market is expected to continue growing steadily, so investing during a recession is effective in the medium to long term. -

Sub-sale property in a good location (huge price difference from the new construction)

In a growing real estate market, it can be said that there is no possibility that the prices of sub-sale properties will drop. The price of a popular property with a good location will increase even if it is a sub-sale property.